Tri-Cities housing prices continue to dip as sales slow across all markets

The Tri-Cities real estate market continued to cool in October, with benchmark prices edging down across most categories and sales slowing to well below seasonal norms.

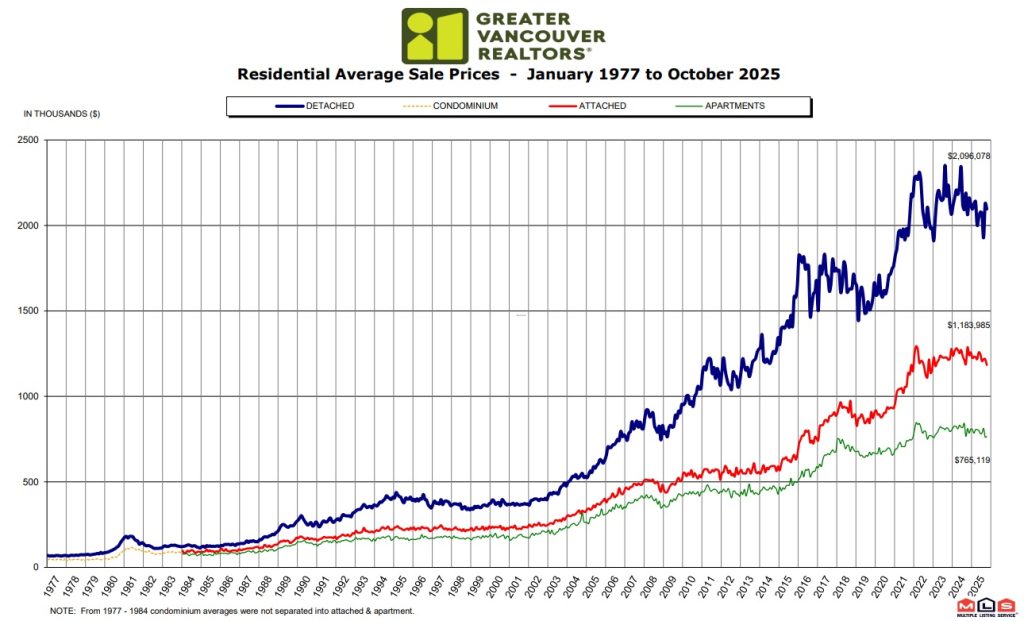

The trend mirrors a broader Metro Vancouver slowdown, where home sales were 14 percent lower than last October and 14.5 percent below the 10-year average, according to the Greater Vancouver Realtors’ (GVR) last market report.

“October is typically the last month of the year where sales activity sees a seasonal uptick, but sales still fell short of last year’s figures and the ten-year seasonal average,” said Andrew Lis, GVR’s chief economist and vice-president of data analytics. “Even the fourth cut this year to the Bank of Canada’s policy rate this October wasn’t enough to entice more buyers back into the market.”

Local news that matters to you

No one covers the Tri-Cities like we do. But we need your help to keep our community journalism sustainable.

Regional numbers

Across Metro Vancouver, 2,255 residential properties sold in October, compared with 2,632 a year earlier. Inventory climbed to 16,393 active listings, up 13.2 percent year-over-year and 35.9 percent above the 10-year average.

The sales-to-active listings ratio fell to 14.2 percent, signalling conditions that favour buyers – particularly for single family homes, where the ratio was just 11.3 percent.

The benchmark composite price across the region declined to $1,132,500, down 3.4 percent from October 2024 and 0.8 percent from September.

Single family homes were benchmarked at $1,916,400 (down 4.3 percent year-over-year), townhouses at $1,066,700 (down 3.8 percent), and apartments at $718,900 (down 5.1 percent).

“After peaking in June, inventory levels have edged lower, and prices have eased across all market segments as slower-than-usual sales activity meets the highest inventory levels seen in many years,” Lis said. “With no further rate cuts expected this year, market conditions appear as favourable for buyers as they’ve been all year.”

Local numbers

In Coquitlam, the composite benchmark price slipped to $1,036,400, down 4 percent from last year and roughly 22.6 percent below the city’s market peak of $1,339,700 in April 2022.

Single family homes are down 5.4 percent year-over-year to $1,706,000, while townhouse prices edged up 0.7 percent to $1,040,800. Apartments slipped 6 percent to $690,700.

For the year to date, 1,812 homes have sold – 6.2 percent fewer than in 2024 and 16.7 percent below the 2022 peak. New listings, however, have surged to 5,242, up 17.1 percent from last year and 37.7 percent higher than at the market’s height.

In Port Coquitlam, the composite benchmark sat at $913,000, down 3.7 percent from last October and 21.4 percent below the city’s pandemic-era high of $1,162,100.

Single family homes are down 6.3 percent year-over-year to $1,364,800, while townhouses climbed 1.8 percent to $898,600. Apartments slipped 5.4 percent to $603,900.

Sales for the year total 613, down 12.9 percent from 2024, and nearly one-third lower than during the 2022 peak. New listings have reached 1,593, up 8.2 percent from last year and 6.6 percent higher than the market’s top year.

Port Moody / Belcarra remains the most expensive pocket of the Tri-Cities, though prices there also continued to edge down. The composite benchmark fell to $1,085,300, down 2.3 percent from last October and 15.7 percent below the April 2022 peak of $1,287,300.

Single family homes averaged $2,081,500, down 2.1 percent year-over-year. Townhomes slipped 3 percent to $1,014,600, and apartments eased 2.5 percent to $727,900.

So far in 2025, 500 homes have sold, down 5.3 percent from 2024, and 16.5 percent below the market peak.

Detached home values across the Tri-Cities are now roughly $200,000 to $400,000 lower than their mid-2022 peaks, translating to a 14–17 percent correction. But they’re still well above pre-pandemic levels, up roughly 30–40 percent over five years.

Benchmark prices:

| Coquitlam | Benchmark price | 1 month change | 3 month change | 6 month change | 1 year change |

| Single-family | $1,706,000 | -0.8% | -1.8% | -4.8% | -5.4% |

| Townhomes | $1,040,800 | -1.1% | -4.9% | -3.7% | 0.7% |

| Apartments | $690,700 | -0.1% | -2.1% | -5.3% | -6.0% |

| Port Coquitlam | Benchmark price | 1 month change | 3 month change | 6 month change | 1 year change |

| Single-family | $1,364,800 | 0.2% | 0.4% | -3.1% | -6.3% |

| Townhomes | $898,600 | -1.7% | -4.9% | -6.0% | 1.8% |

| Apartments | $603,900 | -0.2% | -3.1% | -5.8% | -5.4% |

| Port Moody/Belcarra | Benchmark price | 1 month change | 3 month change | 6 month change | 1 year change |

| Single-family | $2,081,500 | 0.1% | -0.1% | 0.9% | -2.1% |

| Townhomes | $1,014,600 | -0.9% | -2.5% | -2.8% | -3.0% |

| Apartments | $727,900 | 2.4% | -0.5% | -1.0% | -2.5% |