Coquitlam sees biggest rental stock increase in 20 years as Metro Vancouver vacancies hit 30-year high

Metro Vancouver’s rental market has softened sharply, with vacancy rates climbing to their highest level in more than three decades – and Coquitlam is emerging as one of the clearest examples of increased local supply.

According to the Canada Mortgage and Housing Corporation’s (CMHC) annual rental market report released Dec. 11, the overall vacancy rate across Vancouver’s metropolitan area rose above pandemic-era highs, driven by a surge in new rental supply and a drop in demand linked to slower population growth.

In Coquitlam, the city recorded its largest increase in purpose-built rental stock in 20 years, a shift that has translated into significantly higher vacancies – particularly for smaller units.

Local news that matters to you

No one covers the Tri-Cities like we do. But we need your help to keep our community journalism sustainable.

CMHC data shows private apartment vacancy rates for studio units in Coquitlam jumped from just 0.6 percent in October 2024 to 5.5 percent a year later. Over the same period, the number of private apartment units being rented in the city climbed from 3,617 to 4,468.

The increase in supply has begun to put downward pressure on some rents. Average studio rents in Coquitlam fell by eight per cent year-over-year, though price movements differed sharply for family sized units. Average rents for three-bedroom apartments rose by 24 percent, underscoring ongoing shortages for families seeking larger units.

Across Metro Vancouver, CMHC reported a 3.7 percent vacancy rate in the purpose-built rental market, with the average two-bedroom rent reaching $2,363 – up 2.2 percent from last year. In the condo apartment rental market, vacancies sat lower at 1.5 percent, but rents were significantly higher, with two-bedroom units averaging $2,900.

CMHC said the increase in vacancies exceeded expectations, even after forecasting a historically high rate for 2025. While demand in downtown Vancouver has been partially supported by return-to-office and hybrid work policies, vacancy rates in many suburban municipalities are now at or above previous peaks.

The report attributes the softening market to several converging factors, including federal policy changes that reduced the number of temporary workers and international students, slower wage growth, and higher youth unemployment. Many young renters, CMHC noted, are opting to live with roommates or remain with their parents longer.

B.C.’s population growth also slowed significantly recently, with three consecutive quarters of net outflows of non-permanent residents – most of whom were renters. CMHC expects vacancies to remain elevated in the short term as migration levels stay lower.

While Vancouver proper continued to lead the region in new purpose-built rental construction, CMHC highlighted strong rental growth outside the core. Alongside Coquitlam’s two-decade high increase, Burnaby reversed a five-year decline in rental stock and Surrey added significant new supply.

As vacancies rise, rent growth has slowed across the region. CMHC reported the lowest same-sample rent increase in 20 years, falling below the province’s 3 percent maximum allowable rent increase for 2025. They said that is an indication many landlords chose not to raise rents for existing tenants.

The slowdown has been most visible outside Vancouver, where landlords are increasingly offering incentives such as one to two months of free rent to attract tenants, particularly in newer buildings facing longer lease periods.

Despite the cooling market, affordability pressures remain pronounced for lower-income households. CMHC found that only 1 to 2 percent of rental units affordable to households earning below the 60th income percentile were vacant across the region, with especially limited availability for families needing two or more bedrooms.

Rental turnover also increased across Metro Vancouver in 2025, reversing years of decline. CMHC said turnover was highest in newer, higher-end concrete and luxury buildings, where elevated rents gave tenants more incentive to shop around as options expanded.

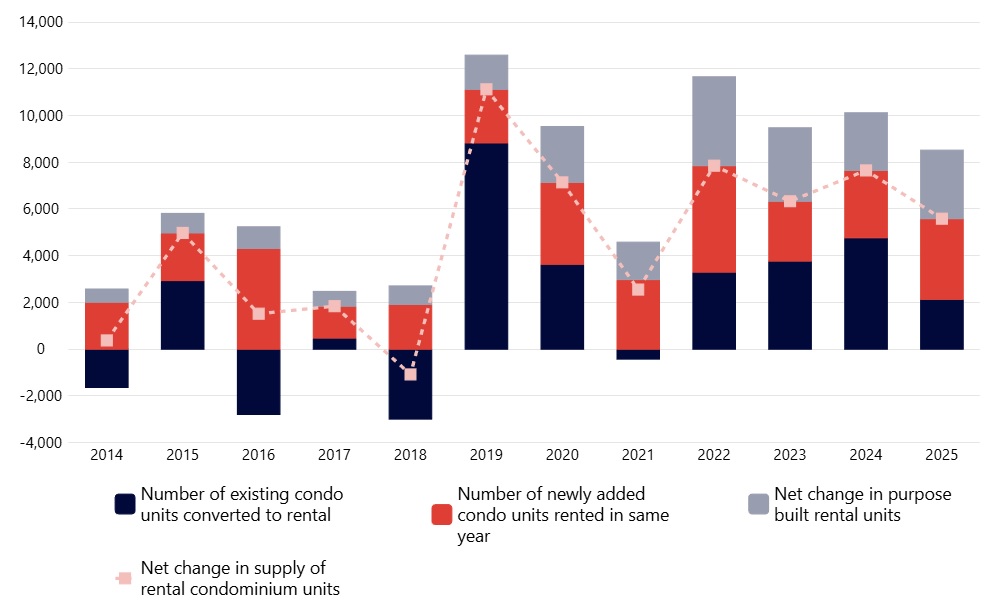

Rental condo apartments continue to play a key role in the region’s housing supply. While vacancy rates for condo rentals rose modestly, they remained below those of purpose-built units, as many owners rely on rental income to cover financing costs and cannot afford prolonged vacancies.

CMHC noted that a sluggish condominium presale market is beginning to affect rental dynamics, with some developers considering converting in-progress condo projects into purpose-built rentals to avoid carrying unsold inventory.