‘Waste of time’: Tri-Cities land assembly Gold Rush dwindling as condo market changes

Perhaps the image that best sums up the Gold Rush that has been the Tri-Cities real estate market is passing a street in which a row of houses – usually located near SkyTrain – have for sale signs in their front yards.

At the top of each sign are the words “land assembly” – meaning all the homes are for sale as part of a package aimed at developers.

In years past, being the owner of a single-detached house that is part of a land assembly is akin to holding a winning lottery ticket, says James Anderson, a Port Moody real estate agent who is outspoken about the housing market in videos on platforms such as TikTok.

Local news that matters to you

No one covers the Tri-Cities like we do. But we need your help to keep our community journalism sustainable.

“It can certainly be lucrative if the market conditions are the right condition,” Anderson told the Tri-Cities Dispatch. “You’re just holding yourself in a contract with a very, very wishful number to try to hit the lottery, basically. And if you’re in a principal residence, it is a lottery. Like if you can make an extra million tax-free, then it’s a great opportunity.”

Or at least it was, said Anderson.

Now, well, land assemblies in Tri-Cities neighbourhoods are mostly languishing, Anderson said with a blunt assessment.

“If we’re in a market like now, then it’s honestly a waste of time,” he said.

Tri-Cities condo sales are dropping and prices are dropping too, leaving developers to focus on land they already own instead of buying new properties, Anderson said.

Homeowners, however, are still filled with “unrealistic” dreams of cashing in, said Anderson, citing one listing for $5 million for a 7,000-square-foot lot.

“It’s hard to say ‘no’ to that as someone who is not in touch with the market,” Anderson said.

That has left developers, for the most part, staying away from land assemblies.

“They’re just sitting there,” he said. “The land valuations are just so high and developers right now don’t need a lot of land; they need to sell or develop the land they already have.”

How land assemblies work

Land assemblies aim to get a developer to buy multiple properties to develop condos or sometimes townhouses.

It’s is started if a group of homeowners gets together to sell their homes, or they’re approached by a real estate agent or a developer.

“It can even be all three,” Anderson said.

The biggest stumbling block at first is getting all of the homeowners in one row to agree to sell. Some are reluctant, which leads to promised prices going up. Realtors have a big job to “manage expectations,” he said.

“It’s tough to get everyone on board because everyone has to want to sell, basically, and that’s why we get these larger-than-actual valuations to convince those people who are a little more on the shelf, on the fence, to do it.”

Once people all agree, a contract is created and the selling begins. Once a price is offered, however, all of the homeowners have to agree on that price. If they don’t, they can pull out – but that means the entire deal falls through for everyone.

People get paid based on the square footage of their lot.

Government pressure

The BC government has made a big push for cities to approve more housing projects to deal with the current housing crisis, even putting together a “naughty list” of those that aren’t approving enough.

The current real estate market, however, is having an impact on future projects.

“The biggest thing that is stopping (land assemblies) is no one is buying,” Anderson said.

The numbers for the Tri-Cities real estate market show sales have slowed and prices have started to drop.

Total residential sales decreased from 378 units in May 2024 to 318 units in May 2025, marking a 15.9 per cent year-over-year decline.

Across all housing types in Coquitlam, Port Coquitlam and Port Moody, median prices have fallen an average of 9.1 per cent over the last three years. Inventory levels across Metro Vancouver have reached a 10-year high, and spring sales – normally a busy period for the market – have been slow, according to a report from the Greater Vancouver Realtors’ (GVR). When it comes to condos, prices in Coquitlam dropped 4.8 per cent from June 2024 to June 2025, 1.4 per cent in Port Coquitlam and 2.5 per cent in Port Moody.

A report by the Fraser Valley Real Estate Board about the Metro Vancouver housing market cites a number of factors for this trend, including the impact of the policies, or threats of policies, by U.S. President Donald Trump.

“There’s no question the economy continues to grapple with unpredictability surrounding trade and tariffs, and the real estate market, like all sectors, is adapting to an uncertain future,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Perhaps this presents an opportunity for government to revisit policy decisions of the past, which may have served their purposes under different market conditions, in support of new economic realities.”

The report stated that with “softening prices” and a large inventory, “it’s a uniquely favourable time” for first-time buyers.”

Anderson said that while prices are lower, the land assemblies are impacted because first-time buyers are looking at condos that have already been built. New projects are funded by investors willing to wait years for planning and construction. Developers need 60 to 70 per cent in pre-sales to fund construction.

“Young people don’t want to wait five years to move into a condo,” Anderson said.

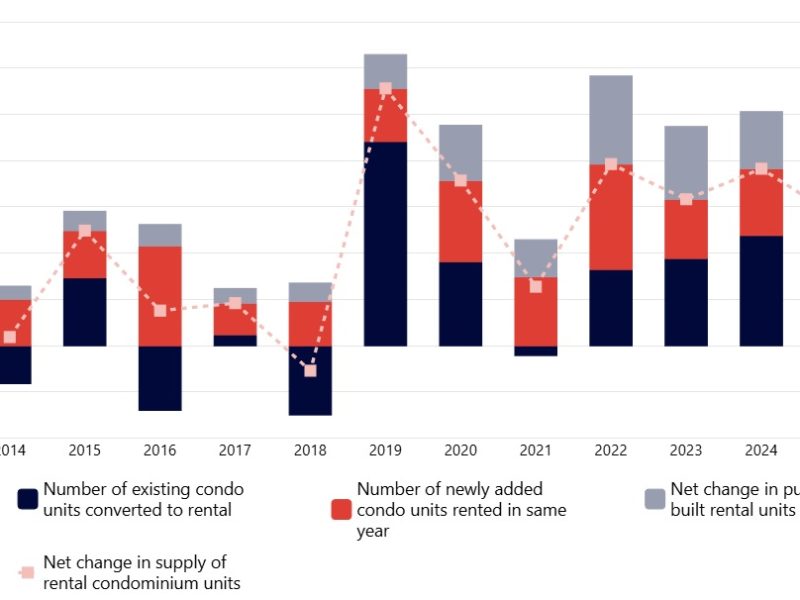

Investors typically have “filled that gap” through pre-sales, Anderson said, but not as much right now, as numbers have been dropping since a peak in 2022.

“There’s just huge drop-offs in pre-sale condo activity … massive drops,” Anderson said.

In response to the changing market conditions, some developers are getting creative with the structure of pre-sales agreements to lure buyers worried that the eventual assessed value of a purchase will end up being lower than what they vowed to pay in the pre-sale agreement.

Allure Ventures in Surrey, for example, has given people a chance to sign a secondary agreement for its SkyLiving project in which the developer agrees to buy back the unit for the original price, or there’s an option in which the unit can be rented out with the promise of a 20 per cent return. Allure has also added a large number of market-rental units to the project.